Back to School: Tax-free weekend starts Aug. 3

Shoppers can save money with a little planning before the 2024 Arkansas Sales Tax Holiday.

Aug. 1, 2024

By Tracy Courage

U of A System Division of Agriculture

Fast Facts

- 2024 Arkansas Sales Tax Holiday is Aug. 3-4

- Items and restrictions: dfa.arkansas.gov/excise-tax/sales-and-use-tax/sales-tax-holiday/

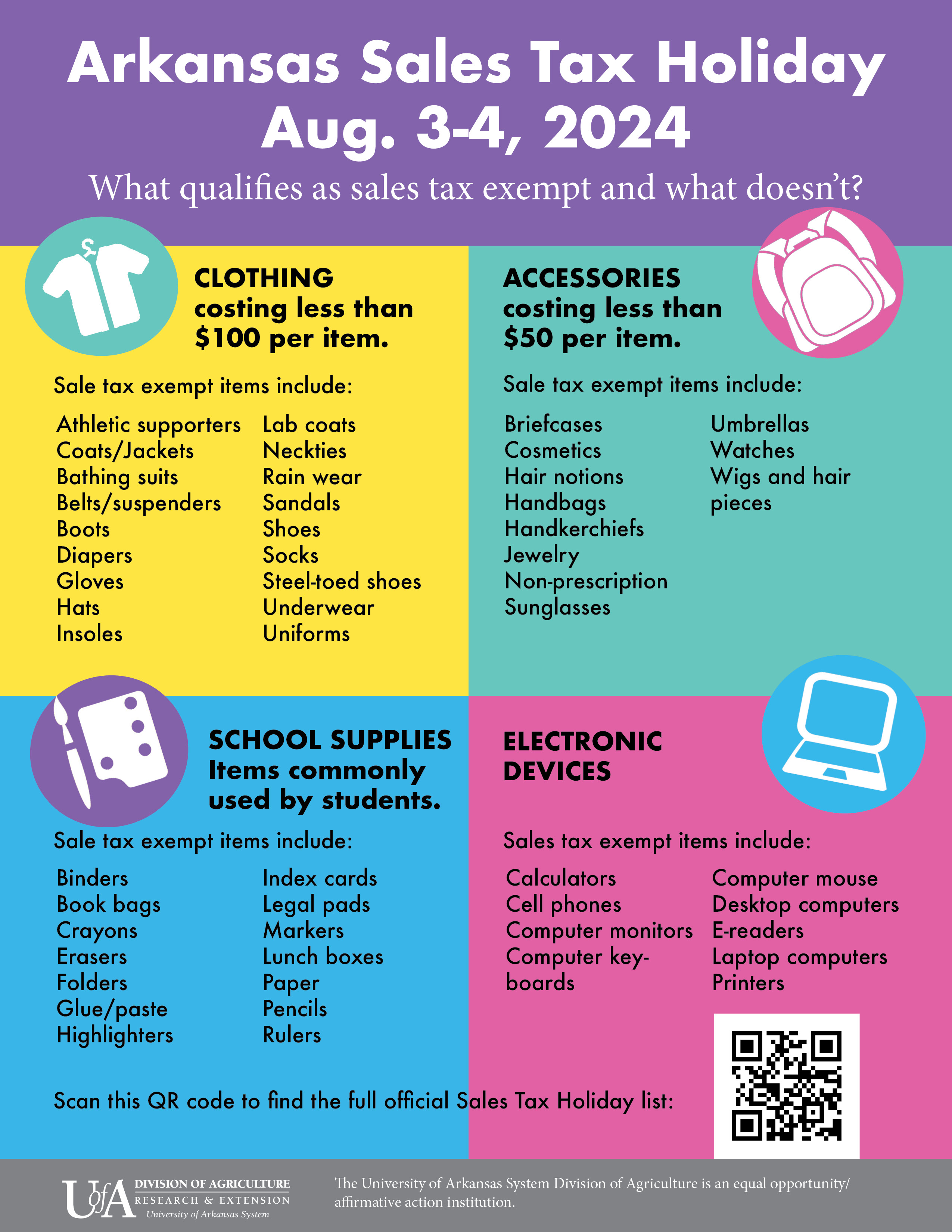

- Tax-free items include clothing, accessories, school supplies, electronics, even diapers

(439 words)

(Newsrooms: Graphic)

LITTLE ROCK — Arkansas’ tax-free weekend can help savvy shoppers save money with a little advance planning.

The sales tax holiday in Arkansas occurs during the first weekend of August each year. This year it begins at 12:01 a.m. Saturday and ends at 11:59 p.m. Sunday. State and local sales taxes will not be collected on the purchase of certain products, and all Arkansas retailers are required to participate.

During the two-day event, shoppers can buy certain electronic devices, school supplies, school art supplies, school instructional materials and clothing — all free of state and local sales or use taxes.

Laura Hendrix, associate professor and extension personal finance expert for the University of Arkansas System Division of Agriculture, said consumers can save money if they plan purchases ahead of time and stick to a budget.

“Although it may be tax-free, it’s still not a bargain if it’s not something you will use,” she said.

What’s Included?

A list of items and restrictions is available at dfa.arkansas.gov/images/uploads/exciseTaxOffice/HolidayItemizedList.pdf

While the list of qualifying items is extensive, some limits apply. The list of qualified clothing, for example, includes clothes, shoes, undergarments, belts, outerwear, even diapers and wedding apparel. Clothing must cost no more than $100 per item, but there is no limit to the number of items. Items for making clothes, such as patterns, fabric, and sewing notions, are excluded.

There is no cost limit on electronics, which include calculators, cellular phones, computers, printers, and computer accessories such as mouses, monitors and keyboards.

Before you shop

Smart shopping strategies during the sales tax holiday are crucial for anyone hoping to cash in on savings.

“This is especially important for large ticket items but also for back-to-school shopping,” Hendrix said. She recommends these tips for anyone trying to save money in the long run:

- Take inventory of what you need or want to purchase.

- Examine your budget and determine how much you will spend.

- Have a plan for how you will pay. Credit card fees and interest can offset any savings you might have from not paying sales tax.

- If using credit cards, pay them off as soon as possible.

- Make a shopping list. Set a spending limit.

- Compare prices to make sure you are getting the best deal.

More practical financial information is available at the uaexMoney blog, uaex.uada.edu/life-skills-wellness/personal-finance/uaex-money-blog/

To learn about Extension programs, contact your local Cooperative Extension Service agent or visit www.uaex.uada.edu. Follow us on X and Instagram at @AR_Extension. To learn more about Division of Agriculture research, visit the Arkansas Agricultural Experiment Station website: https://aaes.uada.edu. Follow on X at @ArkAgResearch. To learn more about the Division of Agriculture, visit https://uada.edu/. Follow us on X at @AgInArk.

About the Division of Agriculture

The University of Arkansas System Division of Agriculture’s mission is to strengthen agriculture, communities, and families by connecting trusted research to the adoption of best practices. Through the Agricultural Experiment Station and the Cooperative Extension Service, the Division of Agriculture conducts research and extension work within the nation’s historic land grant education system.

The Division of Agriculture is one of 20 entities within the University of Arkansas System. It has offices in all 75 counties in Arkansas and faculty on five system campuses.

The University of Arkansas System Division of Agriculture offers all its Extension and Research programs to all eligible persons without regard to race, color, sex, gender identity, sexual orientation, national origin, religion, age, disability, marital or veteran status, genetic information, or any other legally protected status, and is an Affirmative Action/Equal Opportunity Employer.

# # #

Media Contact: Tracy Courage

Director of Communications-Extension

U of A System Division of Agriculture

501-658-2044