Income Tax Schools provide advanced tax preparation training, updates on tax law changes

Aug. 5, 2024

By Tracy Courage

U of A System Division of Agriculture

Fast Facts:

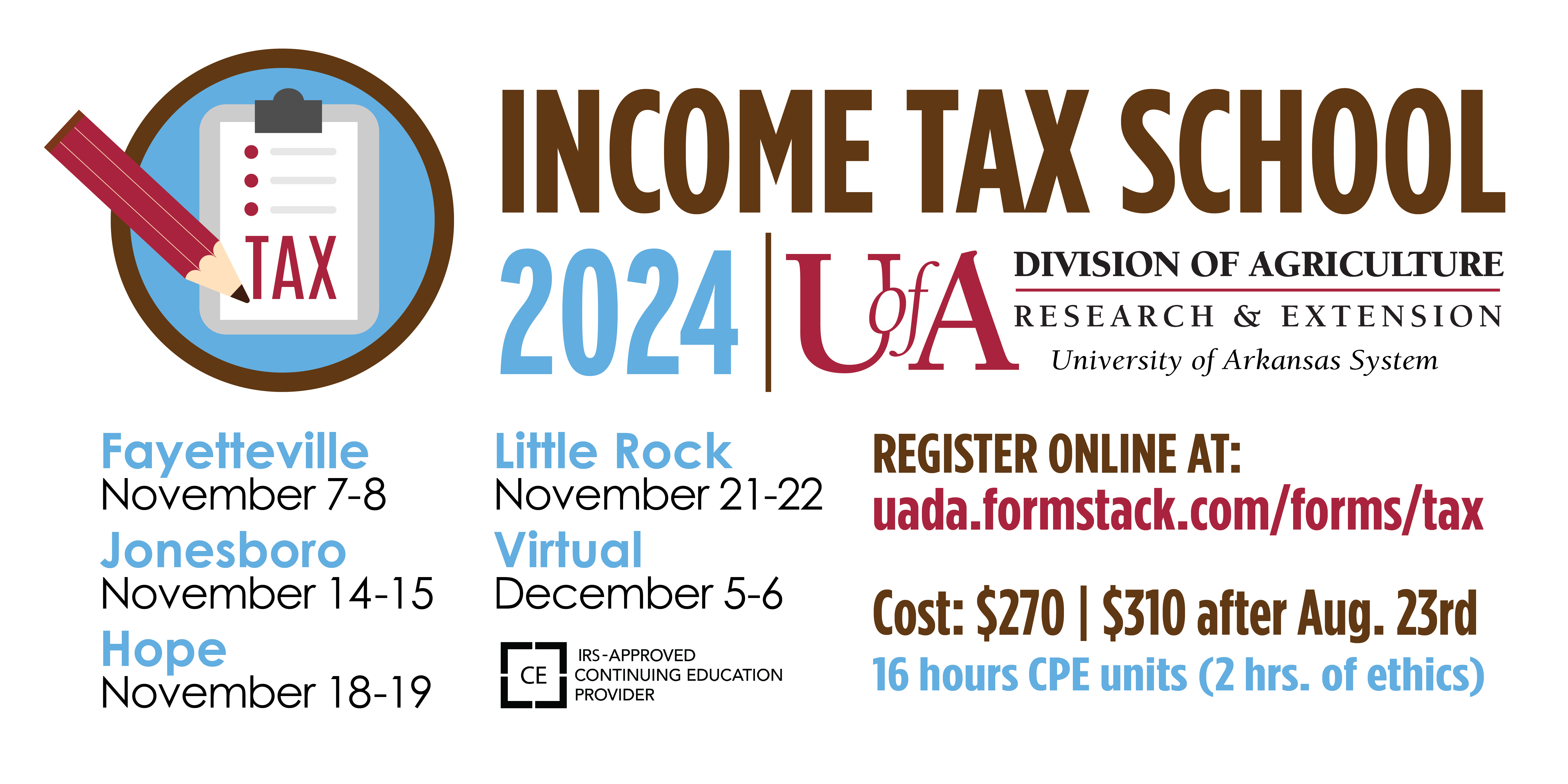

- In-person schools offered in Fayetteville, Hope, Jonesboro, Little Rock in November

- Virtual school available Dec. 5-6

- 16 Continuing Professional Education hours available

- Cost: $270 before Aug. 23; $310 after

- Register at https://uaex.uada.edu/tax-school

(399 words)

LITTLE ROCK — Professional tax preparers and anyone interested in advanced income tax preparation can learn what’s in store for the 2024 tax season by attending one of the University of Arkansas System Division of Agriculture’s Income Tax Schools.

The two-day schools are offered through the Community, Professional and Economic Development unit of the Cooperative Extension Service, part of the Division of Agriculture.

“Whether you have employees, work on your own, or are part of a larger team, you'll need to keep up with new developments and regulations,” Kim Magee, tax school director, said. “Our schools offer a great opportunity to do just that.”

In-person training will be offered in four cities, including:

- Fayetteville — Nov. 7-8, Don Tyson Center for Agricultural Sciences, 1371 Altheimer Drive

- Jonesboro — Nov. 14-15, ASU Delta Center for Economic Development, 319 University Loop

- Hope — Nov. 18-19, Hempstead Hall, 2500 S. Main St. (Building opens and sign-in begins at 8:15 a.m. Class begins at 8:30 a.m.)

- Little Rock — Nov. 21-22, University of Arkansas System Division of Agriculture, Cooperative Extension Service, 2301 S. University Ave.

- Virtual — Dec. 5-6 (online via Zoom) Books will be mailed; Zoom link emailed

The cost of the two-day course is $270 before Aug. 23, or $310 after the priority registration deadline. Registration is available at https://uaex.uada.edu/tax-school.

William “Bill” Laird, a retired Internal Revenue Service agent, and Curtis Davis, a licensed, self-employed CPA with more than two decades of tax experience, will be the instructors. Both are experienced in preparing federal and Arkansas state income tax returns and in teaching others how to do so.

The Income Tax School is approved by the IRS as a continuing education provider. Participants can earn 16 hours of continuing professional education credit, including two hours of ethics.

Classes run 8:30 a.m. - 4:30 p.m. on the first day of class and 8 a.m.- 4:30 p.m. on the second day. A certificate of attendance will be awarded after class is dismissed on the second day. For more information, contact Kim Magee at (501) 671-2081 or kmagee@uada.edu.

To learn about extension programs in Arkansas, contact your local Cooperative Extension Service agent or visit www.uaex.uada.edu. Follow us on X and Instagram at @AR_Extension. To learn more about Division of Agriculture research, visit the Arkansas Agricultural Experiment Station website: https://aaes.uark.edu. Follow on X at @ArkAgResearch. To learn more about the Division of Agriculture, visit https://uada.edu/. Follow us on X at @AgInArk.

About the Division of Agriculture

The University of Arkansas System Division of Agriculture’s mission is to strengthen agriculture, communities, and families by connecting trusted research to the adoption of best practices. Through the Agricultural Experiment Station and the Cooperative Extension Service, the Division of Agriculture conducts research and extension work within the nation’s historic land grant education system.

The Division of Agriculture is one of 20 entities within the University of Arkansas System. It has offices in all 75 counties in Arkansas and faculty on five system campuses.

The University of Arkansas System Division of Agriculture is an equal opportunity institution. If you require a reasonable accommodation to participate or need materials in another format, please contact Kim Magee at (501) 671-2081 or kmagee@uada.edu as soon as possible. Dial 711 for Arkansas Relay.

# # #

Media Contact: Tracy Courage

Director of Communications-Extension

U of A System Division of Agriculture

501-658-2044