Posts

Contact

Frank Seo

CPED

Email: fseo@uada.edu

University of Arkansas System Division of Agriculture

Cooperative Extension Service

2301 S. University Avenue

Little Rock, AR 72204

Booming Arkansas: How Migration is Fueling Population Growth and Driving Up Housing Prices

Southern states have experienced a large migration due to the COVID-19 pandemic, with Arkansas emerging as a notable beneficiary. A Federal Reserve Bank of Kansas City study reported that many people moved out of their homes in large urban areas in favor of small and medium urban areas during the pandemic, primarily motivated by high living costs. The latest U.S. Census Bureau data indicates that this state-to-state migration is primarily concentrated in the southern states, including Arkansas.

The Census highlights that Fayetteville recently reached a milestone, surpassing a population of 100,000. Nearby in Benton County, Centerton was the sixth fastest-growing city in the United States between July 1, 2022, and July 1, 2023 (Figure 1). These findings suggest the migration driven by the pandemic is continuing, and the influx of new residents will likely impact the local economy.

Figure 1.

Top 15 Fastest-Growing Cities by Percent Change Between July 1, 2022, and July 2023

As Arkansas experiences a notable surge in migration, a pressing question arises: To what extent has COVID-19 related migration increased the state's housing landscape?

While fluctuations in house prices can be attributed to various factors, a fundamental economic principle — supply and demand — offers insight into this phenomenon. Between April 1, 2020, and July 1, 2022, Arkansas saw a net migration of 38,055 people from across the United States, along with 4,754 foreign-born residents choosing to settle in the Natural State. As a result, this led to a net migration of 42,809 individuals to Arkansas in a two-year time frame (Brown, 2023). Therefore, it's plausible to surmise that the increasing demand has driven up house prices, but the specifics of this dynamic warrant closer examination.

How exactly has this trend unfolded?

Preliminary data from our 2024 Rural Profile of Arkansas answered this question. The 2024 Rural Profile of Arkansas compared the Zillow Home Value Index (ZHVI), which is a smoothed, seasonally adjusted measure of typical home values in the 35th to 65th percentile range. Given the World Health Organization (WHO) declaration of COVID-19 as a pandemic on March 11, 2020, the analysis spans from March 31, 2020, to March 31, 2024, to see how the Arkansas housing market has changed.

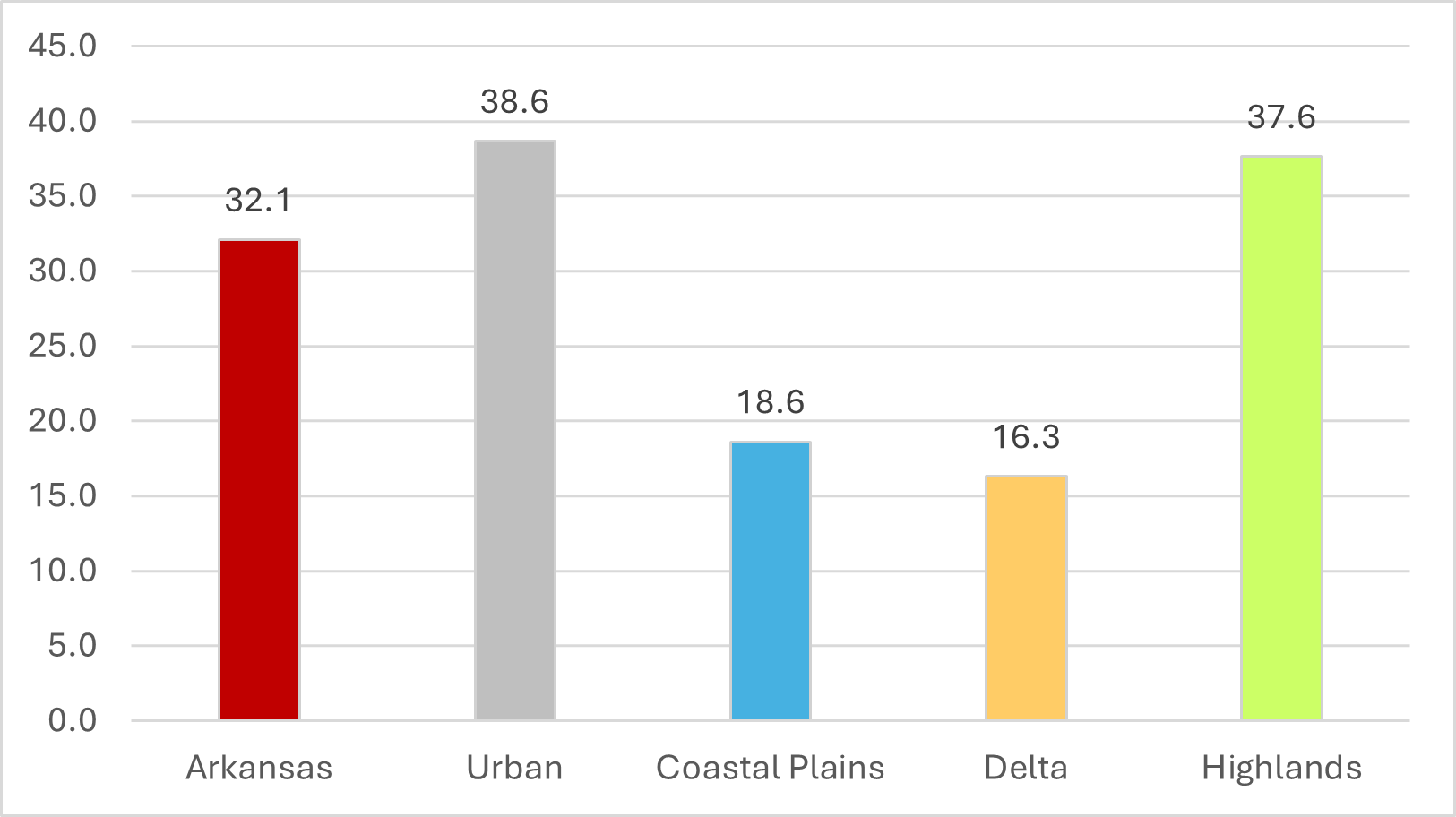

The data shows that the average house value in Arkansas, including single-family houses and condos, increased from $114,170 to $150,791 over this time period (Figure 2). This represents a 32% rise.

To be more specific, average house values in both the Urban and Highlands regions of Arkansas increased by around 38%. Meanwhile, the average house values in the Coastal Plains and Delta areas of Arkansas increased by less than half of the Urban and Highlands regions.

Figure 2.

Percent Change in Zillow Home Value Index in Arkansas from March 31, 2020, to March

31, 2024

Arkansas Regions and Housing Prices

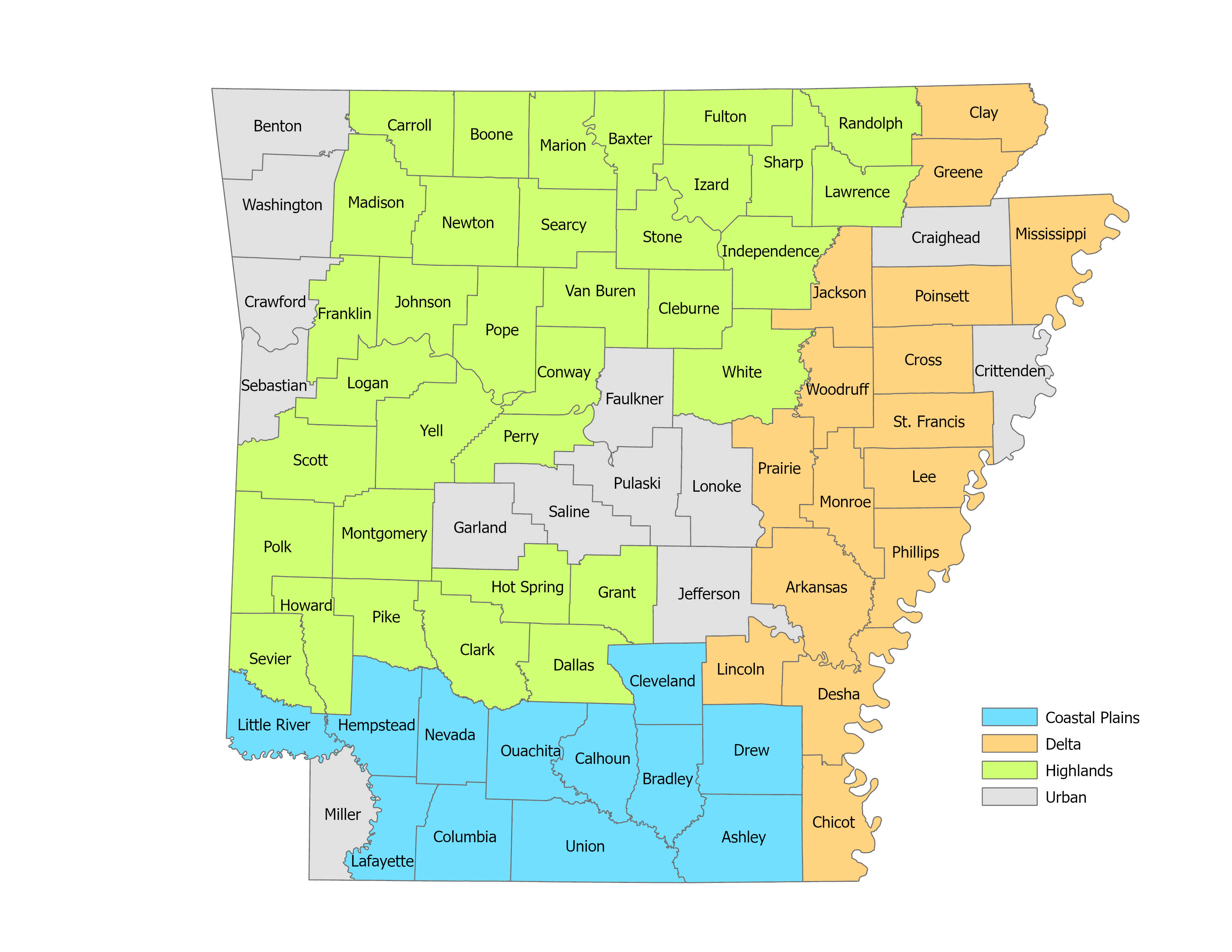

The Coastal Plains of Arkansas include the southern counties of Little River, Hempstead, Lafayette, Nevada, Columbia, OUachita, Union, Calhoun, Cleveland, Bradley, Drew and Ashley counties.

Urban areas of Arkansas include northwest Arkansas counties of Benton, Washington, Crawford, and Sebastian counties, along with central Arkansas counties of Garland, Saline, Faulkner, Pulaski, Lonoke, and Jefferson counties, and counties on the east such as Craighead and Crittenden.

Highland areas of Arkansas include counties outside the Delta, Urban, and Coastal Plain areas. The Delta counties fall along the state's eastern edge but exclude Craighead and Crittenden counties.

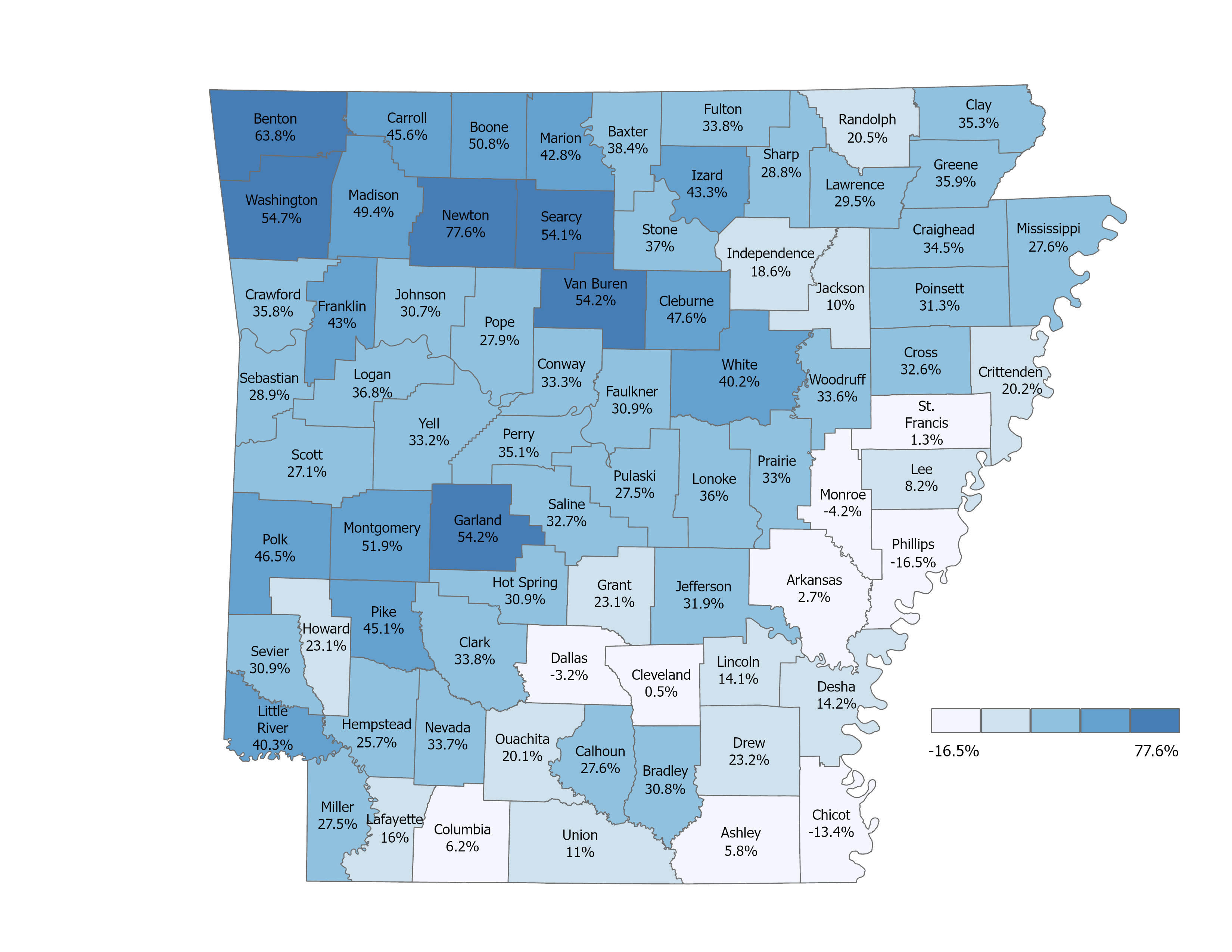

Furthermore, Figure 3 shows the percent change in the ZHVI by county from March 31,

2020, to March 31, 2024. As we can see, the change in house prices vary greatly from

the northwest to the southeast. While housing prices in Arkansas’ northwestern region

drastically increased, prices in the southeastern area remained stagnant or even decreased

in some regions. A spatial autocorrelation analysis result supported that there is

a less than 1% likelihood that this clustered pattern could be the result of random

chance. In addition, this clustered pattern aligns with the recent net domestic migration data from the Census. As a result, the southeast stands out as an exception to the rising

migration trends and surging housing market values observed in other regions.

Figure 3.

Percent Change in Zillow Home Value Index by County in Arkansas from March 31, 2020,

to March 31, 2024

Note: There is a less than 1% likelihood that this clustered pattern could be the result of random chance with 0.569 of Global Moran’s I, 6.731 of Z-score, and 0.000 of p-value

Shifts Require Policy Reviews

While numerous factors can influence the housing market, our research indicates notable housing price fluctuations during the pandemic migration period. These shifts raise concerns regarding housing affordability and accessibility, particularly in Urban and Highland regions, as well as the infrastructure development in the southeast area.

The influx of new Arkansas residents underscores the need for careful examination of its impact on existing residents in the coming years. Accordingly, some potential policy questions that arise include: What strategies can be adopted to promote affordable housing initiatives, especially for low-income individuals and families? How can public-private partnerships be leveraged to support infrastructure development in regions experiencing rapid population growth? What measures can be taken to address potential social and cultural integration challenges that may arise from increased diversity within communities? The surge of new Arkansas residents prompts a call for thorough scrutiny of the impact on existing residents in the future.